Freelancers and independent contractors often face challenges when it comes to tracking their income. Unlike traditional employees, contractors do not receive standard paystubs from an employer, making it difficult to maintain accurate financial records. This is where a paycheck creator becomes an essential tool. It helps contractors generate professional paystubs, track earnings, and manage taxes efficiently. In this guide, we will explore how a paycheck creator can benefit contractors, ensuring smooth financial management and compliance.

Understanding a Paycheck Creator

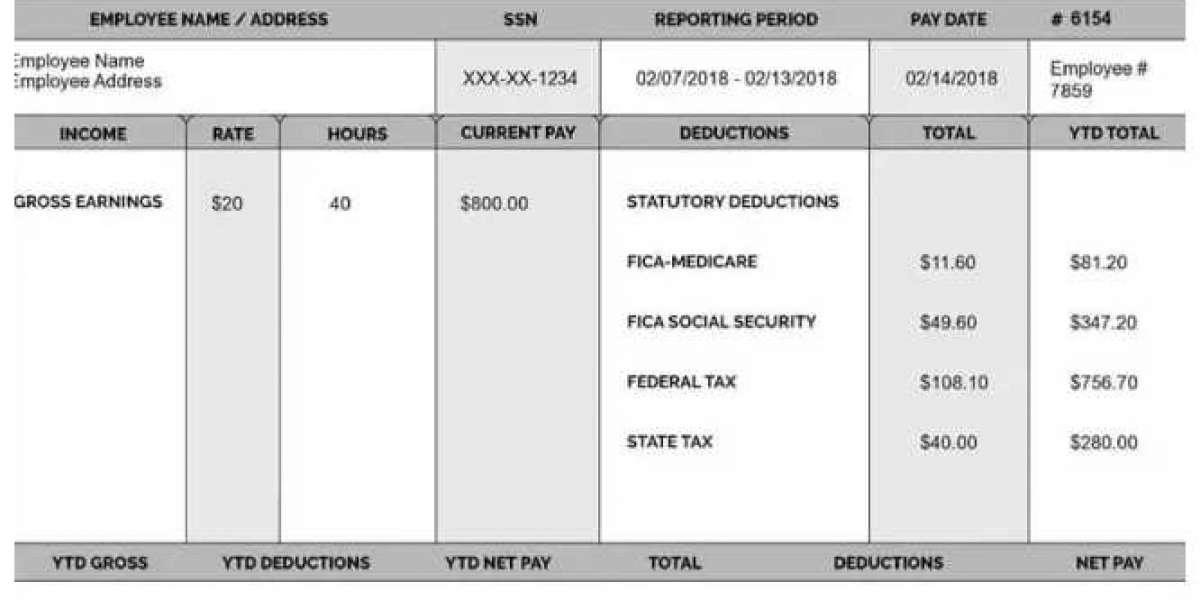

A paycheck creator is an online tool that allows users to generate paystubs quickly and easily. These paystubs serve as proof of income, helping independent workers keep track of their payments from various clients. The tool typically requires users to input essential details, such as hourly rates, total hours worked, and deductions like taxes or benefits. Once completed, the paycheck creator generates a professional paystub that can be saved for record-keeping.

Why Contractors Need a Paycheck Creator

1. Accurate Income Tracking

One of the biggest challenges for contractors is tracking multiple streams of income from different clients. Since they do not receive a consistent paycheck from one employer, it can be easy to lose track of payments. A paycheck creator helps by providing a structured way to document earnings, ensuring that no payment is overlooked.

2. Proof of Income for Loans and Rentals

Contractors often struggle to prove their income when applying for loans, mortgages, or rental agreements. Traditional employees have paystubs from their employers, but independent workers must provide their own documentation. A paycheck creator allows contractors to generate official-looking paystubs, which can be used as proof of income when needed.

3. Simplifies Tax Filing

Tax season can be stressful for contractors who do not have an employer handling tax deductions. A paycheck creator helps keep track of income and deductions, making it easier to file taxes accurately. By using paystubs created with the tool, contractors can have a clear record of their earnings and expenses, reducing the risk of errors when filing returns.

4. Professionalism in Financial Records

Having organized financial records is crucial for contractors. A paycheck creator ensures that contractors can generate professional paystubs that make their business appear more legitimate. Whether dealing with clients, tax authorities, or financial institutions, having structured paystubs adds credibility to a contractor’s financial profile.

Features of a Good Paycheck Creator

Not all paycheck creators are the same. When choosing one, contractors should look for key features that ensure accuracy and ease of use.

User-Friendly Interface: A simple and intuitive design makes it easy to input information and generate paystubs quickly.

Customization Options: The ability to customize fields such as company name, contractor details, payment breakdowns, and deductions.

Automatic Tax Calculations: Helps estimate tax withholdings based on income levels, ensuring contractors are aware of their tax responsibilities.

Download and Print Options: Allows users to save, print, or email paystubs for record-keeping or submission to financial institutions.

How to Use a Paycheck Creator

Using a paycheck creator is simple and requires just a few steps:

Enter Personal and Business Details

Include your name, business name (if applicable), and contact information.

Input Payment Details

Enter the amount earned per project or hourly rate, along with the total hours worked.

Include Deductions (If Needed)

Some paycheck creators allow users to input estimated tax deductions or other withholdings.

Generate and Save the Paystub

Once all details are entered, the paycheck creator will generate a professional paystub. Download or print it for future use.

Benefits of Using a Paycheck Creator for Contractors

1. Saves Time

Instead of manually tracking income and expenses, a paycheck creator automates the process, saving valuable time.

2. Helps with Budgeting

With accurate paystubs, contractors can better understand their earnings and plan expenses accordingly.

3. Keeps Records Organized

Having digital or printed paystubs helps maintain clear financial records, which are useful for audits or financial reviews.

4. Enhances Credibility

When dealing with clients, banks, or landlords, professionally generated paystubs add legitimacy to a contractor’s business.

Conclusion

For independent contractors, tracking income is a critical part of managing finances. A paycheck creator simplifies this process, allowing contractors to generate paystubs that serve as proof of income, assist with tax filing, and keep financial records organized.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?